When it comes to forex trading youll be met with the same forex and cfd trading tax implications in australia as you would if you were share trading. Division 775 does not apply to financial arrangements that are subject to division 230 of the itaa 1997 refer to taxation of financial arrangements tofa.

Top 7 Forex Brokers For 2019 Compared

Top 7 Forex Brokers For 2019 Compared

Hi ato im a forex trader that has just gotten into a live trading account.

Fore! x trading capital gains tax australia. The ato is mainly concerned with your profits losses and expenses. Implications and interaction of capital gains tax cgt forex provisions and taxation of financial arrangements tofa rules for foreign exchange gains and losses. You pay day trading income tax on whats left after expenses including losses at your personal tax rate.

I will call in short term as forex trading capital gains tax uk for people who are looking for forex trading capital gains tax uk review. The key point to note is that any gains you make from day trading are considered taxable income but you can also claim losses as tax deductions. Private investor your gains and losses will be subject to the capital gains tax regime.

Reviews forex trading capital gains tax uk is best in online store. Section 988 is a tax regulation governing capital losses or gains on investments held in a foreign currency. A section 988 tr! ansaction relates to section 988c1 of the internal revenue cod! e.

Unfortunately that means there is no tax free forex trading in australia nor in any other asset. If you contact hmrc they will help confirm which tax status you fall under. The vehicle you used to generate your income is secondary.

If you contact hmrc they will help confirm which tax status you fall under. Unfortunately that means there is no tax free forex trading in australia nor in any other asset. If a gain or loss is brought to tax both under division 775 and under another provision of the tax law it is respectively assessable or deductible only under these measures.

On the whole youll be met with the same forex and cfd trading tax implications in australia as you would if you were share trading. The ato is mainly concerned with your profits losses and expenses. Im an australian resident for tax purposes i also have a full time job out on the mines in the nt.

!  The 2019 Guide To Cryptocurrency Taxes Cryptotrader Tax

The 2019 Guide To Cryptocurrency Taxes Cryptotrader Tax

Forex Com Review 2019 Forex Com Scam Or Legit Forex Broker Expert

Forex Com Review 2019 Forex Com Scam Or Legit Forex Broker Expert

Forex Trading Market Trade Forex In Australia Axitrader

Forex Trading Market Trade Forex In Australia Axitrader

Compare Online Forex Trading Platforms In Australia Finder Com Au

Compare Online Forex Trading Platforms In Australia Finder Com Au

Is Forex Trading Profit Taxable In Australia

Largest Forex Brokers By Volume In 2018 Fair Reporters

Vantage Point Trading How Much Money Day Traders Can Make Stocks

Vantage Point Trading How Much Money Day Traders Can Make Stocks

Taxes Trading In Australia What Tax Is Due Trading Cfds Or Forex In Oz

Taxes Trading In Australia What Tax Is Due Trading Cfds Or Forex In Oz

Realistic Forex Income Goals For Trading Trading Strategy Guides

Realistic Forex Income Goals For Trading Trading Strategy Guides

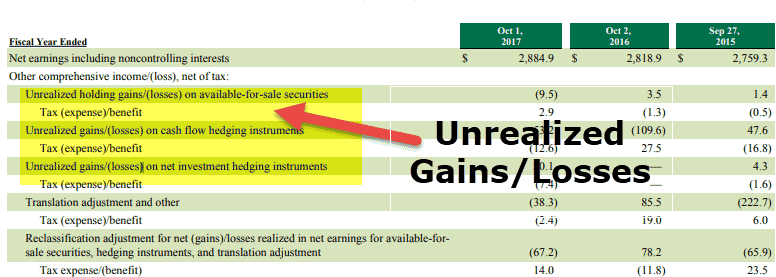

Unrealized Gains Losses Examples Accounting For Unrealized

Unrealized Gains Losses Examples Accounting For Unrealized

Australia Personal Income Tax Rate 2019 Data Chart Calendar

Australia Personal Income Tax Rate 2019 Data Chart Calendar

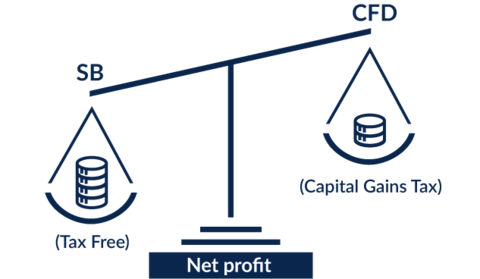

Difference Between Spread Betting Vs Cfd Trading Cmc Markets

Difference Between Spread Betting Vs Cfd Trading Cmc Markets